In this blog I will share lessons learnt from Scandinavia in terms of looking after all of their people, including their indeginous Sami people. Let’s travel to the Far North in Europe, Norway. Norway stretches 1,750km from the South to the Northern border with Russia near Kjerkenes. Its rugged coastline stretches two times the distance around the equator. This is about eight (8) times the coastline of New Zealand. Both countries have stunning scenery, low population base outside of their major cities. And both have indigenous people populating the countries many centuries ago. New Zealand and Norway have about the same population size, around five (5) million people.

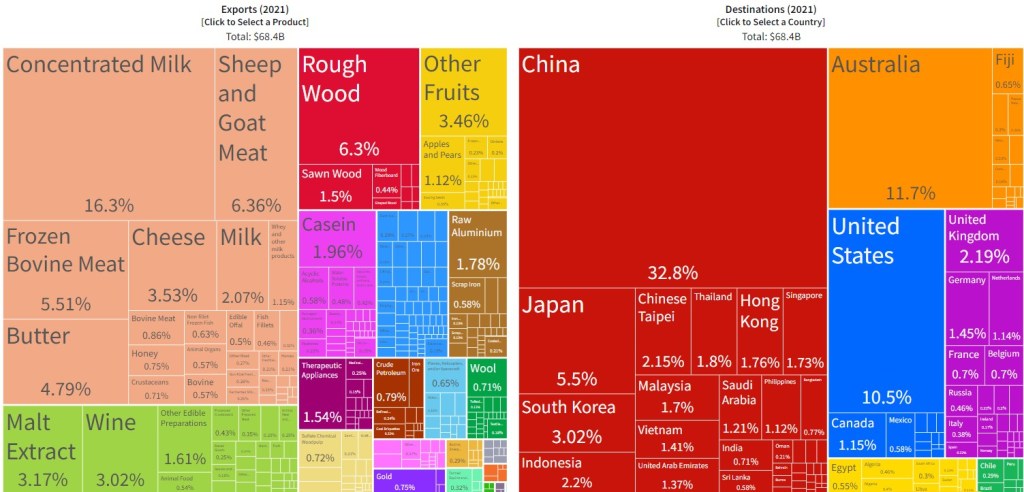

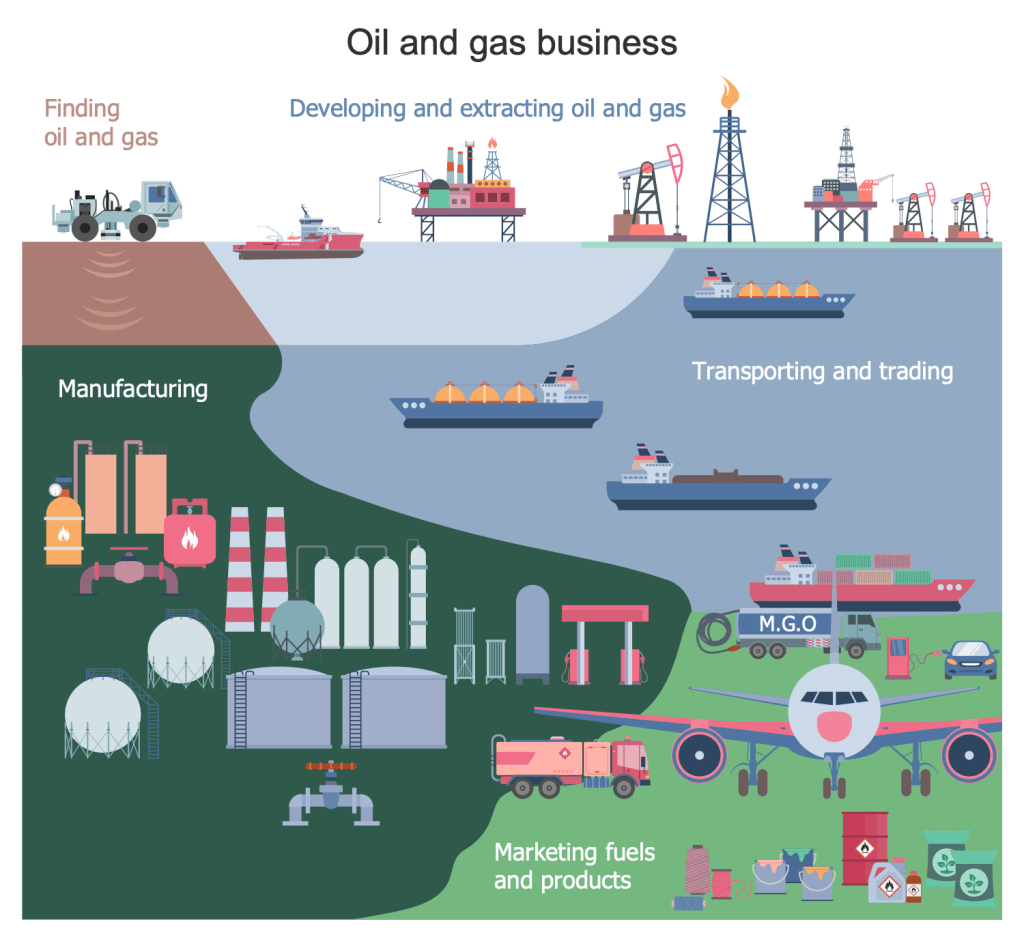

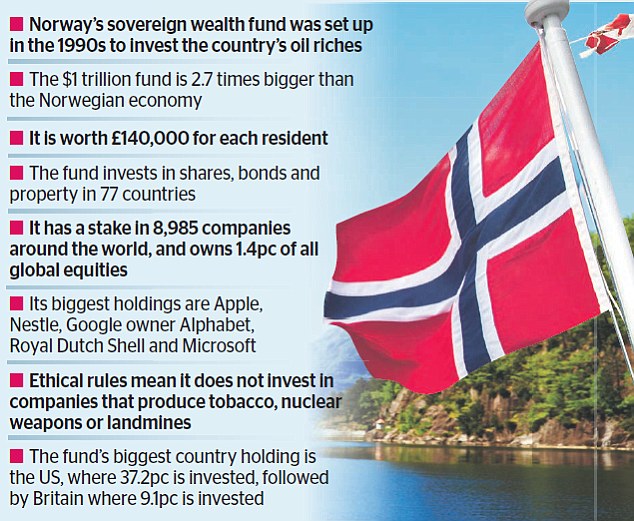

However, in 2022 the GDP per person in Norway was USD 106,177 and in Aotearoa it is less than half USD 48,418. In 2023 the Norwegian Sovereign Wealth Fund was the biggest in the world, bigger than the US, Japanese Sovereign Wealth Fund. The Norwegian Sovereign Wealth Fund was worth USD 1.6 Trillion, its interest generated in 2023 equalled about 70% of the GDP of New Zealand.

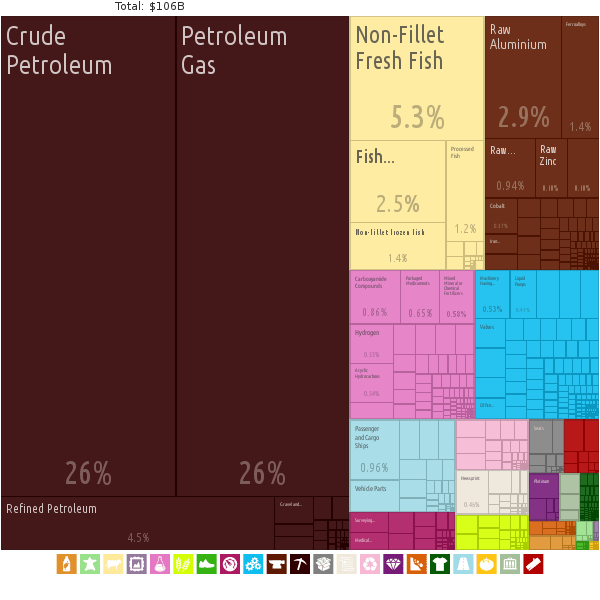

What is the reason for this amazing difference in wealth of these two comparable nations. Here is a comparison on their exports a few years ago in the style of a treemap

Source: World Bank

As you can clearly see that Norway is still generating the biggest income from its oil and gas exports. Whereas NZ is exporing milk powder and food, mainly to China (over 32%).

How did Norway get into the financial position they are now in?

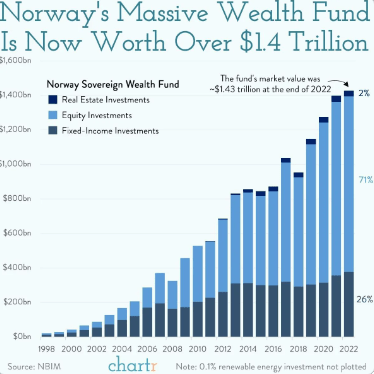

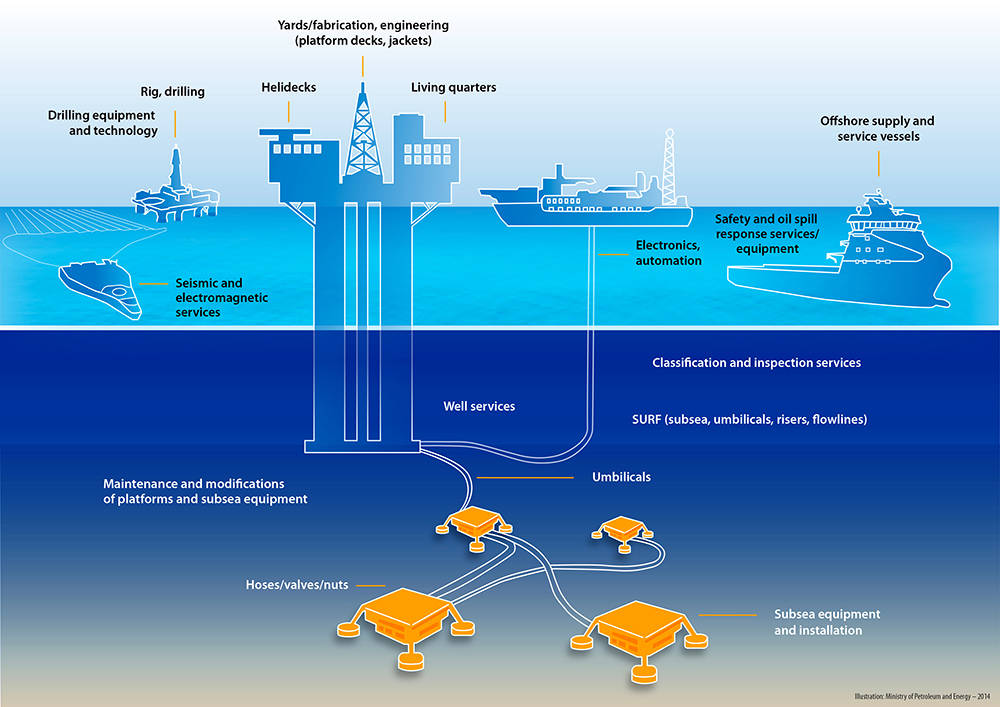

In the 1960s Norway and Scotland found oil & gas in the North Sea to almost equal proportions. At the time Norway was one of the poorest countries in Europe, close to Switzerland. Both were poor fishing or farming nations. A bit like NZ these days. Norway in contrast to Scotland decided to own the whole value chain of oil & gas extraction, refining, distribution. They even build the oil rigs, offshore oil ships, pipelines and many other innovations. Scotland, as NZ, outsourced all the oil & gas exploration to multinationals like Shell, BP and others. NZ did the same with OMV. Only Todd Energy is holding small shareholdings in NZ’s oil & gas exploration. Most Kiwis don’t see any of the oil & gas windfall made in NZ waters.

Getting back to the Norwegian situation. In the 1990s Norway decided to start a Sovereign Wealth Fund. They hired the best managers they could find globally and then build up their own talent in Norway. Today their Sovereign Wealth Fund is the most successful fund of its kind in the world. And is run by Nicolai Tangen, a Norwegian native. Nicolai’s team invested in high tech companies and generated a huge windfall for the Norwegian Sovereign Wealth Fund. This benefits the whole Norwegian society. It results in some of the best education, health care and infrastructure on the planet. Norway is now an innovator in electrical vehicle recharging technologies and an innovation & investment power house. That wasn’t the case early last century.

Sources: Conceptdraw, Norsk Petroleum

What does all this mean for Aoteaora?

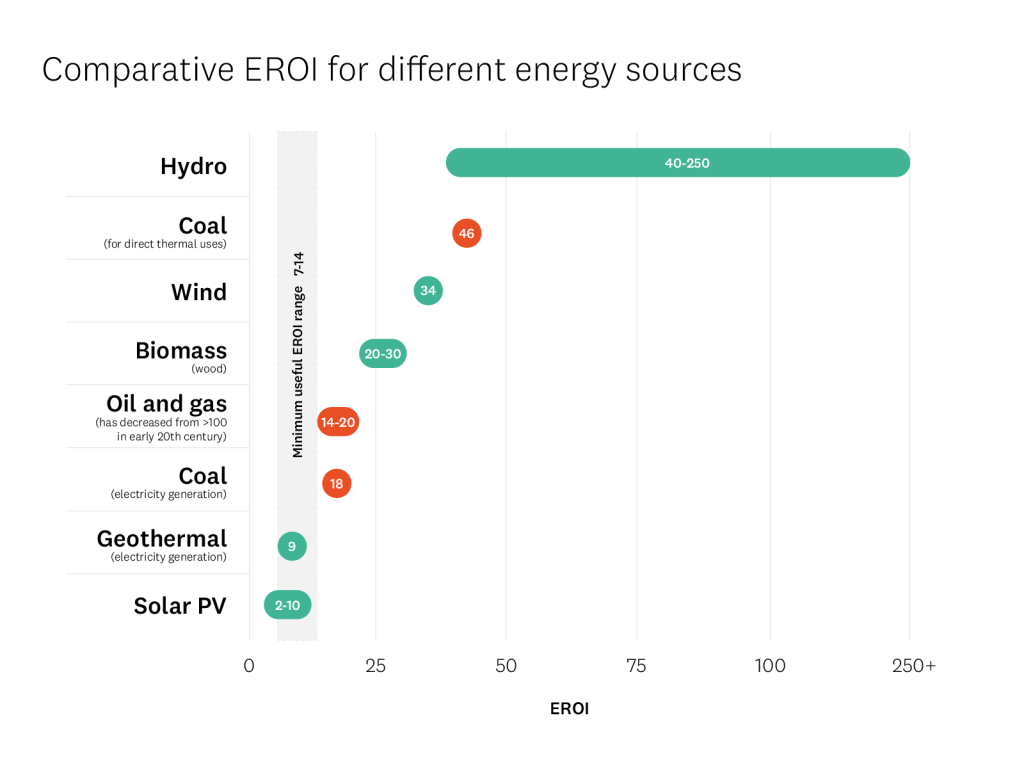

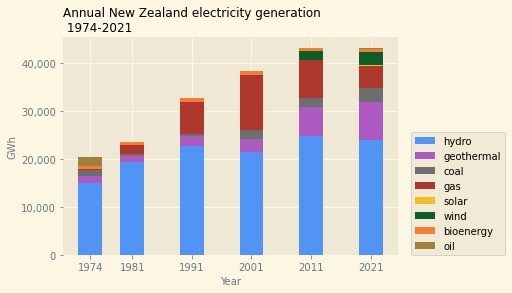

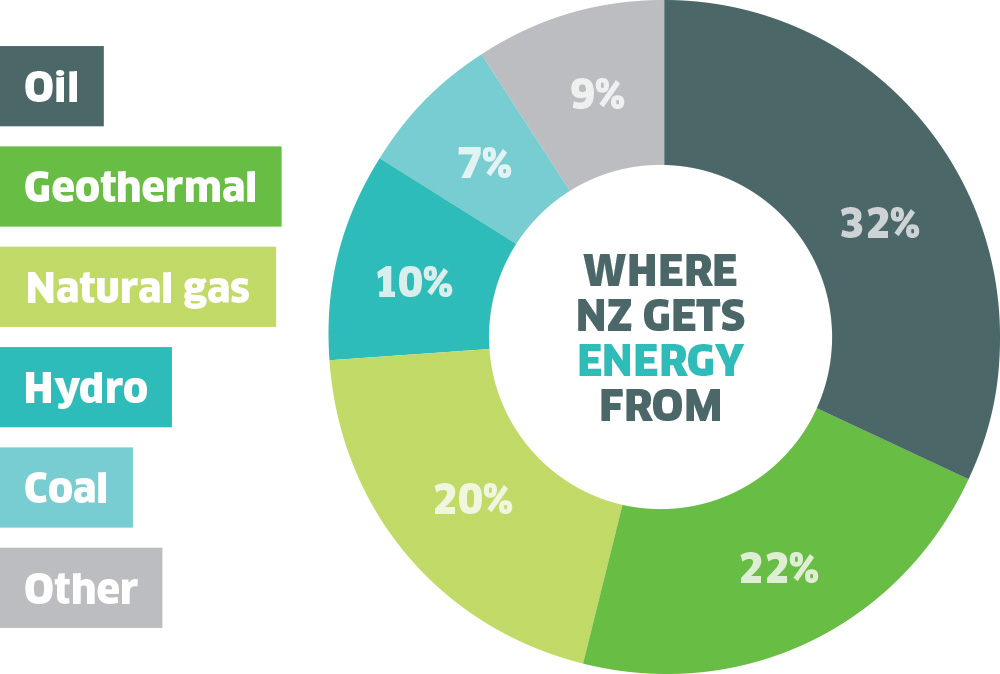

With the transition from fossil fuels to renewables, NZ is a the cusp of a another Future Energy transition. If done stragecially well, this could mean that NZ becomes a global leader in renewable energy and that all Kiwis, including Maori, benefit from this transition.

Sources: EECA, Ministery of Energy

In 2024 about 85% of all NZ’s electricity is generated by renewable energy. With all the consented geothermal, wind and solar farms, NZ could be 100% renewable in no time. The expertise in hydro, geothermal, onshore wind, solar and ocean energy (OE) could be leveraged for global consultancy and governance services. And bring significant revenue back to Aotearoa.

How can we establish a successful Sovereign Wealth Fund in NZ?

First we should upskill ourselves on global best practices. Then we should get rid of political agendas and do what is best for all Kiwis. Also get a good understanding how the Norwegians pulled this off. Find answers to the following questions … What should be our NZ flavour of a Sovereign Wealth Fund? How should it be managed? How should the profits be best invested? What skill set, experience do we need to best do this?

The way how Ngai Tahu has managed their settlement funds is a great NZ role model. We can learn from this and leverage this experience to build something for all New Zealanders.

So what are we waiting for …

Source: Mother Tongues, Polynesian/ Viking debate+

Let’s catch up with our Viking friends in Norway and show how our Polynesian, Kiwi Ingenuity can bring happiness and prosperity to all New Zealanders.

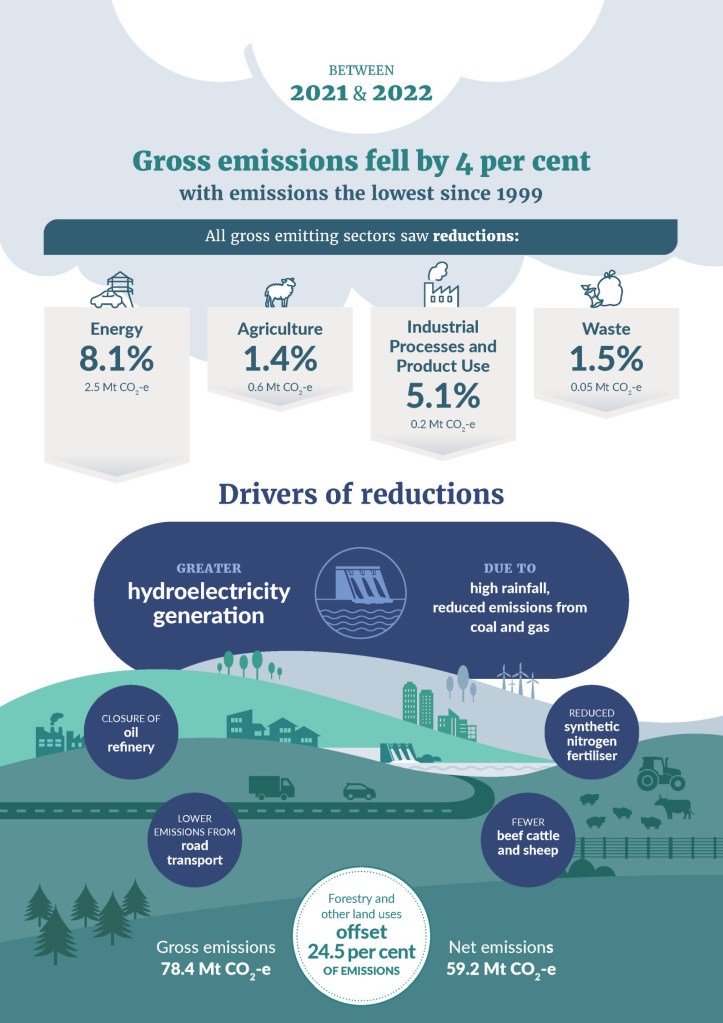

…and now some more good news, NZ’s GHG are sinking. We are moving in the right direction. They need to sink further.

Source: Newsroom

One thought on “Aotearoa Future (Energy) Sovereign Wealth Fund (AFE-SWF)”