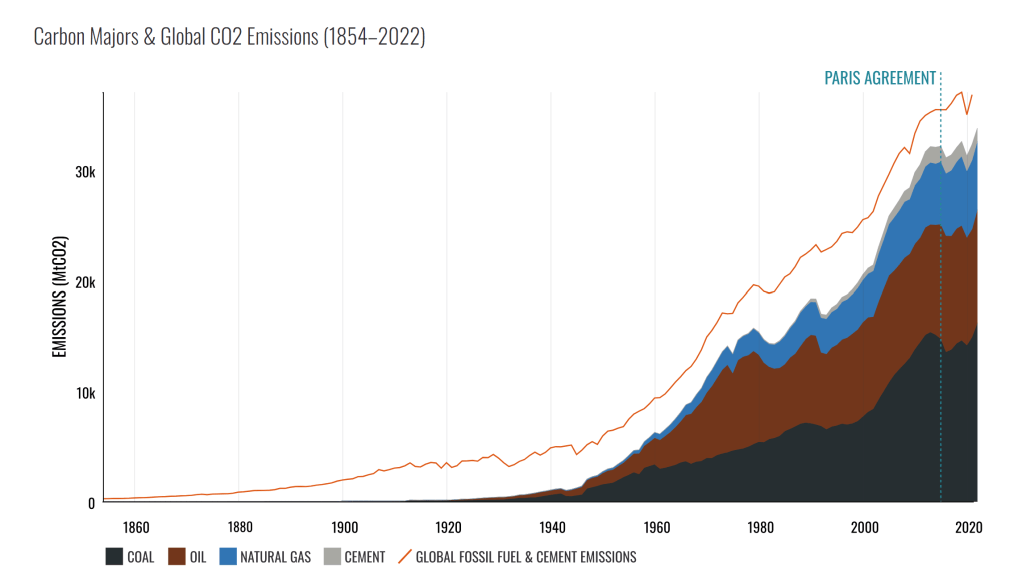

We live in ‘interesting times’ – Coal consenting is supposed to come easier under the current tripartite NZ government from April 2024.

Does this all make sense? I don’t know.

However, join me on a thought experiment.

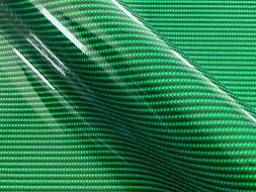

What if the NZ tax and rate payer stops subsidising the big Australian Multinational Rio Tinto with the cheapest electricity on the planet and NZ would be bold to bet the farm on the fastest growing advanced material – green carbon fibre?

You shrug and think, what is he on about now … Hold that thought.

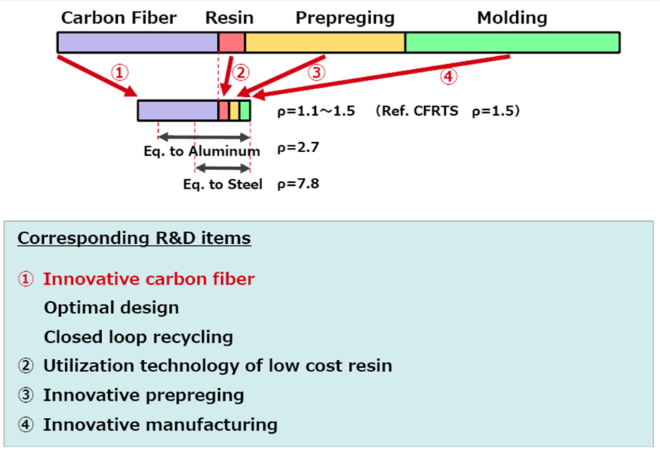

First a few statistics on carbon fibre (CF), especially green carbon fibre (GCF). GCF is CF produced with renewable energy. The automotive, aerospace, space sector are itching to shift to GCF. The demand is skyrocketing. And the best news is, GCF can be sold at up to 20 x the price of the highly subsidized alloy Rio Tinto is selling on the global market. And, you can air lift GCF in its various stati, as well become a trusted supplier to the aerospace and space industry.

You may ask, that is fine enough, but how could Aotearoa play in this ‘Big Boys’ game.

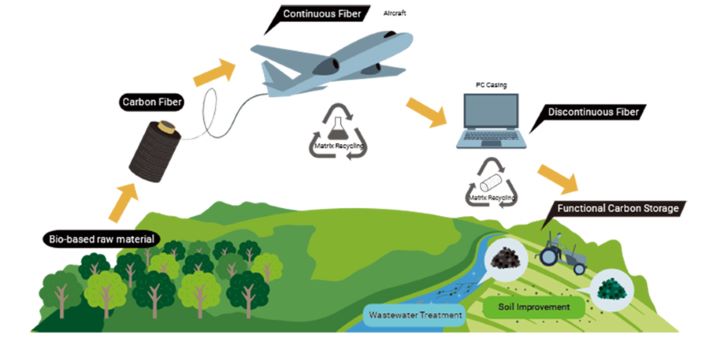

There are a few things where NZ is naturally endowed, quite different to most countries which currently produce and export carbon fibre globally. NZ has all the key ingridients for carbon fibre at our door step. This includes coal, fibre (from trees) and lots of green, renewable energy. The carbon fibre production process works like the following.

With the Meridian Energy run Manapouri Hydro Dam, NZ produces around 850MW of green power. At present this renewable energy is largely used to power the Tiwai Point Aluminium Smelter in Bluff, at the bottom of NZ.

The Australian company Rio Tinto (with USD 54 bn revenue, which equals a fifth of NZ’s GDP) has been running the Tiwai Point site since and had cancelled the contract with NZ in 2019. However, the NZ tax and rate payer is still subsidizing so called “green aluminium” in the light of saving jobs. If my above argument is accurate, switching from alluminium to green carbon fibre could not only save the jobs at Tiwai Point but allow for secondary carbon fibre industry to grow in the region and wider New Zealand. NZ could become a preferred supplier of truly green carbon fibre on the global market. Just think of that for a moment.

In the same thought, think that NZ founded Rocketlab was the first company from the Southern Hemisphere to successful land an object on the moon (see my post from October 2023). If we can put things on the moon, surely we can bring in NZ investors and entrepreneurs to transition from foreign owned aluminum production to 100% Kiwi owned and operated green carbon fibre production. Or am I wrong … who likes to take up this challenge and massive global market development opportunity …

This green carbon fibre production and growth of NZ Renewable Energy could allow Kiwis to build the Aotearoa Future (Energy) Sovereign Wealth fund (see my post from April 2024).

Check out these excellent publications on carbon fibre and carbon fibre-reinforced polymers (CFRPs).

But, as you know there always is a but, the “but” on green carbon fibre is what do you do with the material when it comes to its “end of life”. If you do a proper “cradle-to-cradle” lifecycle analysis, you need to address the reuse, recycle issue. The Guardian looked at this a few years ago. At the time there weren’t many good “end of life” solutions, yet. The good news is that carbon fibre products last a long time: the current generation of wind turbine blades and electric vehicles won’t be heading to the wrecking yard for at least another decade. Perhaps by the time the second generation retires, we will have somewhere better to put their precious carbon fibres than a hole in the ground. We expect that this will change over time. “But” to the author’s knowledge it is not available in April 2024.

Full disclosure, the above idea is not my original idea, but is credited to the amazingly visionary Susan Lake from Core Builder Composites and Sail GP. You are a true inspiration and visionary. Many thanks for sharing your insights on this huge opportunity for Aotearoa.